This strategic shift reflects our conviction that the US will continue to provide a favourable environment for corporate performance and recognises the increasing proportion that the US accounts for in global equity markets.

However, we acknowledge that following strong performance in recent years - particularly by a few large technology companies – the S&P 500 Index now sits at elevated valuations and concentration levels relative to history. Our analysis continues to reaffirm that valuations are among the most reliable indicators of long-term future returns, particularly when they reach extremes, suggesting caution.

Therefore, we think it’s prudent to elect a more diversified approach. By incorporating non-market cap weighted strategies – which don’t weigh stocks by a company’s market size – this approach ideally complements our existing S&P 500 position. Specifically, we have introduced allocations to Exchange Traded Funds (ETFs) which track the S&P 500 Equal Weighted and S&P MidCap 400 indices, which offer attractive diversification and return potential.

The US landscape

As we move through 2025, the US economy continues to demonstrate resilience, driven by a combination of consumer strength, low unemployment levels, and robust corporate profitability. Historically, the US has remained a preferred destination for investors due to its deep capital markets, innovative industries, and a responsive policy environment. With inflation showing signs of stabilisation and the Federal Reserve maintaining a measured approach to interest rates, the economic backdrop remains supportive for long-term equity performance.

However, risks persist. Elevated valuations in the S&P 500 pose a challenge, with many large-cap technology stocks priced for perfection. Market concentration remains a concern, as the dominance of a few mega-cap names has increased the risk of sharp corrections if earnings growth expectations falter. Additionally, geopolitical uncertainty, fiscal policy shifts, and potential interest rate surprises continue to warrant investor caution.

Selecting our non-market capitalisation US allocation

In determining the most suitable choice for our non-market cap US allocation, we considered several indices that represent various segments of the investable US equity market. Below we briefly outline some of the key factors considered:

Expected returns

Our analysis involved forecasting long-term expected total returns for each index. These forecasts were primarily driven by our outlook on earnings growth, valuation adjustments (towards historical averages), and dividend yields.

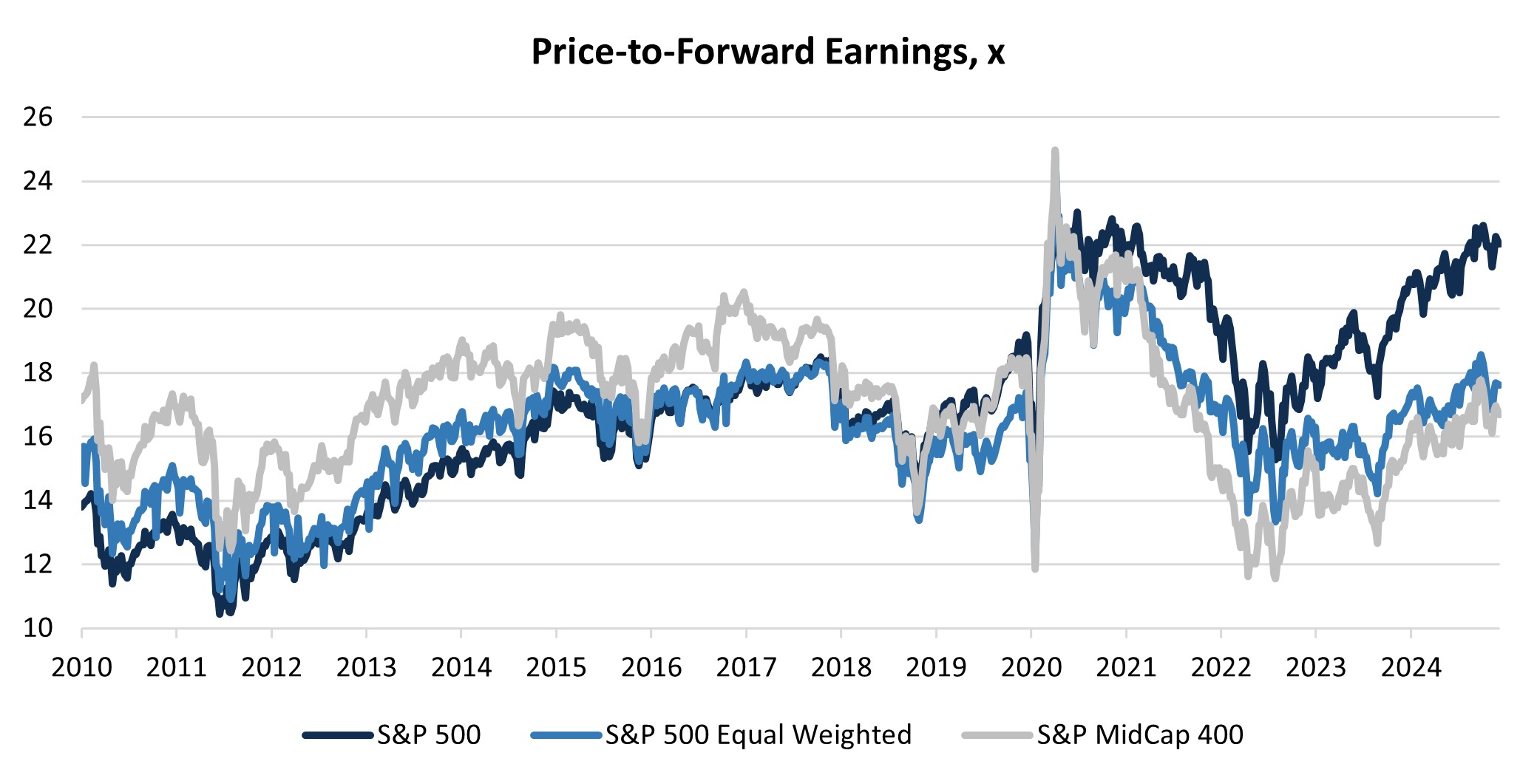

In our analysis of the US fund universe, the S&P 500 Equal Weighted and S&P 400 indices emerged as particularly attractive investment prospects. This is largely attributable to their current modest valuations, which are closer to historical averages (see the chart below). This resulted in less significant negative valuation adjustments in our return forecasts. Coupled with relatively high dividend yields and robust expected earnings growth, these two indices exhibit highly attractive total return potential going forward.

12m Forward Price-to-Earnings Ratio- S&P 500, S&P 500 Equal-weight and S&P 400

Source: Bloomberg, Netwealth

Conversely, although we expect market-capitalisation-weighted indices (such as the S&P 500 and the Nasdaq) to also generate healthy earnings growth in future, they are currently very expensive. Indeed, the outlook for the indices is a function of their historic success from layered optimism on earnings and valuations – which negatively impacts our return forecasts. Furthermore, relatively small dividend yields contribute to less attractive total return prospects over our forecast horizon of around 10 years.

Diversification

We are wary of overexposure to the S&P 500 index because it is becoming increasingly influenced by a small number of highly valued technology stocks. As the saying goes, "don't put all your eggs in one basket"; so, investing more in this index now could leave us overly vulnerable to potential stock-specific, sector-specific, or thematic risks.

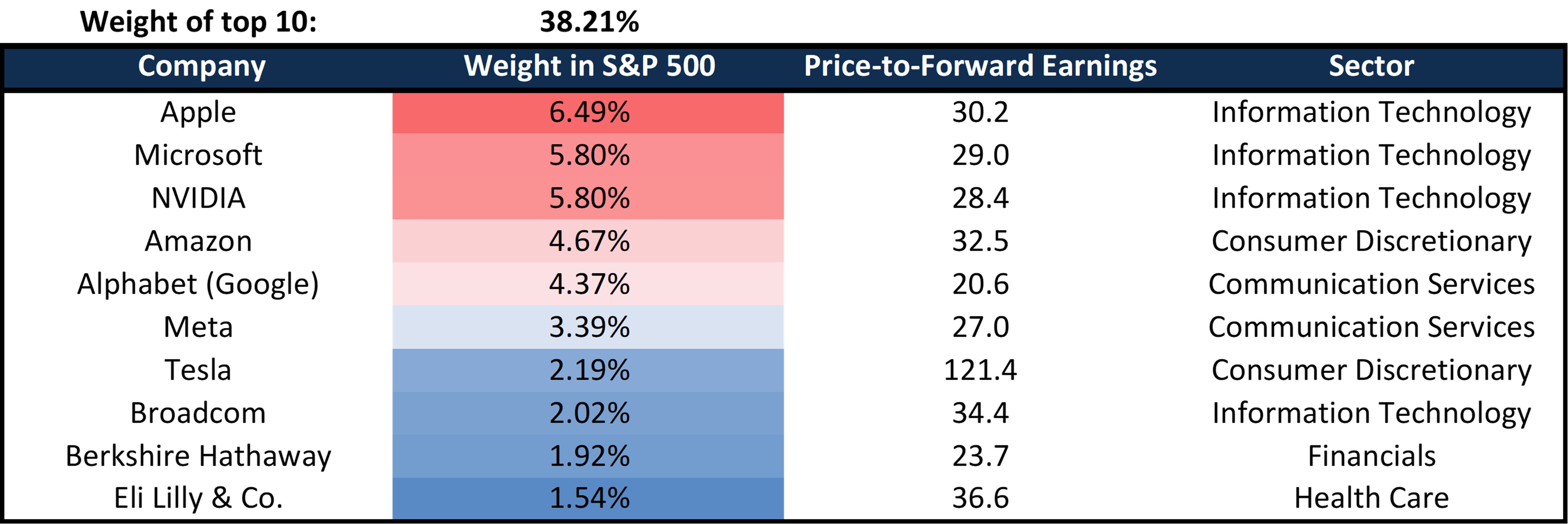

S&P 500 top 10 holdings, Bloomberg (February 2025)

Source: Bloomberg, Netwealth

The top ten companies in the S&P 500 are dominated by expensive technology stocks– the familiar names in the table above – and now represent a substantial 38.2% of the index. Much of their recent growth has been fuelled by investors expecting continued strong growth in the coming years, driven by the wider adoption of artificial intelligence and the belief that only the companies with the biggest resources would be able to drive progress in the fast-moving sector.

However, as recently highlighted by the shockwaves sent through the US tech industry on the release of an impressive new open-source AI model from Chinese startup Deepseek, perpetual dominance in this space by companies such as market-leading chipmaker Nvidia is not a forgone conclusion.

A non-market-cap weighted approach, such as equal-weighting or mid-cap exposure, offers significant diversification benefits by reducing the influence of these dominant companies. This mitigates the risk associated with a potential correction in these individual stocks.

The S&P 500 Equal Weight index – due to its construction approach – has a much lower exposure to these dominant names, with the top ten holdings remaining relatively constrained at around 2%, even though the universe of securities is the same as the S&P 500 Index itself. Furthermore, this index exhibits a more balanced sector exposure.

Similarly, the S&P 400 has relatively low concentration in individual names and sectors, with its top ten holdings representing approximately 6.7% of the index.

Performance broadening amid changing market dynamics

A key theme anticipated for the coming year is the prospect of a broadening of market performance, moving beyond the concentrated leadership of a few “mega-cap” stocks. This shift is predicated on changes in the wider economy and a reduction of the earnings growth divergence that has characterised recent years.

The recent dominance of technology stocks, particularly within the so-called "Magnificent Seven" (the top 7 names in the table above), stems from a confluence of factors. The pandemic accelerated digital transformation, boosting demand for e-commerce, remote working technologies, augmented reality and cloud computing. These developments fundamentally reshaped market dynamics, favouring large technology firms.

More recently, advances in artificial intelligence have further cemented their leadership. Additionally, a prolonged period of elevated inflation and higher interest rates led to higher borrowing costs, which disproportionately benefited these companies. Their strong balance sheets and substantial cash reserves insulated them from the need for external financing, an advantage not shared by many other firms.

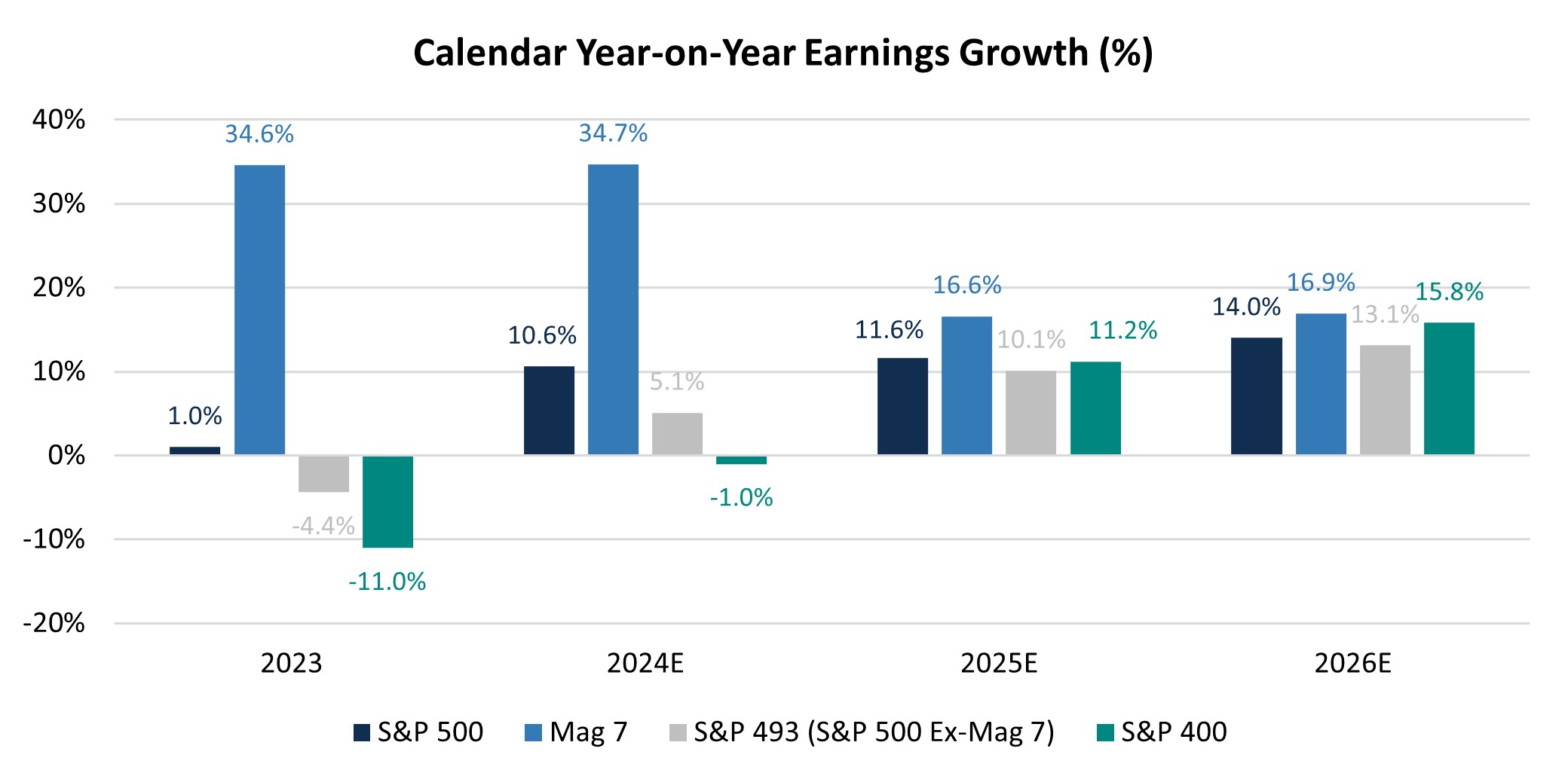

The extraordinary performance of these companies in recent years underpins their stellar stock performance and increase in valuation. The chart below illustrates this trend, highlighting their outsized contribution to US earnings growth.

Notably, when we exclude these seven firms, the S&P 500 experienced negative year-on-year growth in 2023. While these companies continue to exhibit higher relative earnings growth, the gap between them and the broader market has narrowed in recent quarters. This trend is expected to continue in the coming years.

Historic and expected earnings growth – S&P 500, Mag-7, Market ex-Mag-7 and Mid-caps

Source: Bloomberg, Netwealth

Looking ahead, the macroeconomic backdrop appears increasingly favourable for a broader section of companies to succeed. This shift should create opportunities beyond the technology sector, particularly for cyclical stocks (those closely linked to an economy’s strength such as construction, luxury goods and travel) and smaller companies that have been constrained by high interest rates. Pro-growth economic policies, such as deregulation and tax cuts from the new administration, could further support this trend. Mid-cap stocks, which tend to be more sensitive to domestic economic growth and interest rates, stand to benefit significantly.

At the same time, the ongoing race among mega-cap technology firms to expand artificial intelligence capabilities – with exuberant spending in this space – has raised concerns over future profitability. Uncertainty regarding how they will make money could create further headwinds for these companies. These dynamics suggest that earnings growth will become more evenly distributed across the S&P 500, with mid-cap stocks playing a greater role.

A more balanced market structure should bolster equal-weighted and mid-cap indices, supporting their relative performance in the years ahead. As the earnings cycle broadens, investors may find increased opportunities beyond the largest technology firms, leading to a healthier and more diversified market environment. We believe this should provide a positive backdrop for the Netwealth portfolios.

More information on selected indices

S&P 500 Equal Weighted: Includes the same 500 large-cap US stocks as the S&P 500, but with each assigned an equal weighting. This reduces concentration risk and provides more diversified large-cap exposure. As with the S&P 500, these companies account for roughly 80% of US market capitalisation.

S&P 400 MidCap: Tracks 400 mid-sized US companies. It represents a segment of the market that falls between the large-cap S&P 500 and the small-cap S&P 600, accounting for approximately 10% of the total US market. Mid-caps balance growth potential and financial stability, offering higher quality than small-caps and greater sensitivity to interest rates and domestic growth than large-caps.

Russell 2000 (small-cap): Covers small-cap stocks (approximately 7% of US market). Not selected in our review due to weaker investment case, reflecting deteriorating quality (specifically with regards to profitability) and elevated valuations on recent decline of earnings.

In summary

By broadening our US equity investments we seek to strike a balance between capturing growth opportunities and managing risk. The inclusion of the S&P 500 Equal Weight and S&P 400 indices enhances portfolio diversification, reduces reliance on a narrow group of dominant companies, and positions portfolios to benefit from the evolving economic landscape.

We remain committed to delivering superior investment outcomes by adapting to market dynamics and employing evidence-based strategies. If you would like to know more about how we can help you reach your investment goals, please get in touch.

Please note, the value of your investments can go down as well as up.