Expert Wealth Management at a lower cost, powered by technology

Modern wealth management led by a team of experts and a technology-enhanced approach

Our Philosophy

We believe wealth management should combine the best elements of a traditional discretionary service with the benefits of a technology-enhanced approach.

So we have brought together a highly qualified team, a powerful online service, a robust investment framework and access to experienced advisers if needed – all at a fraction of the industry cost.

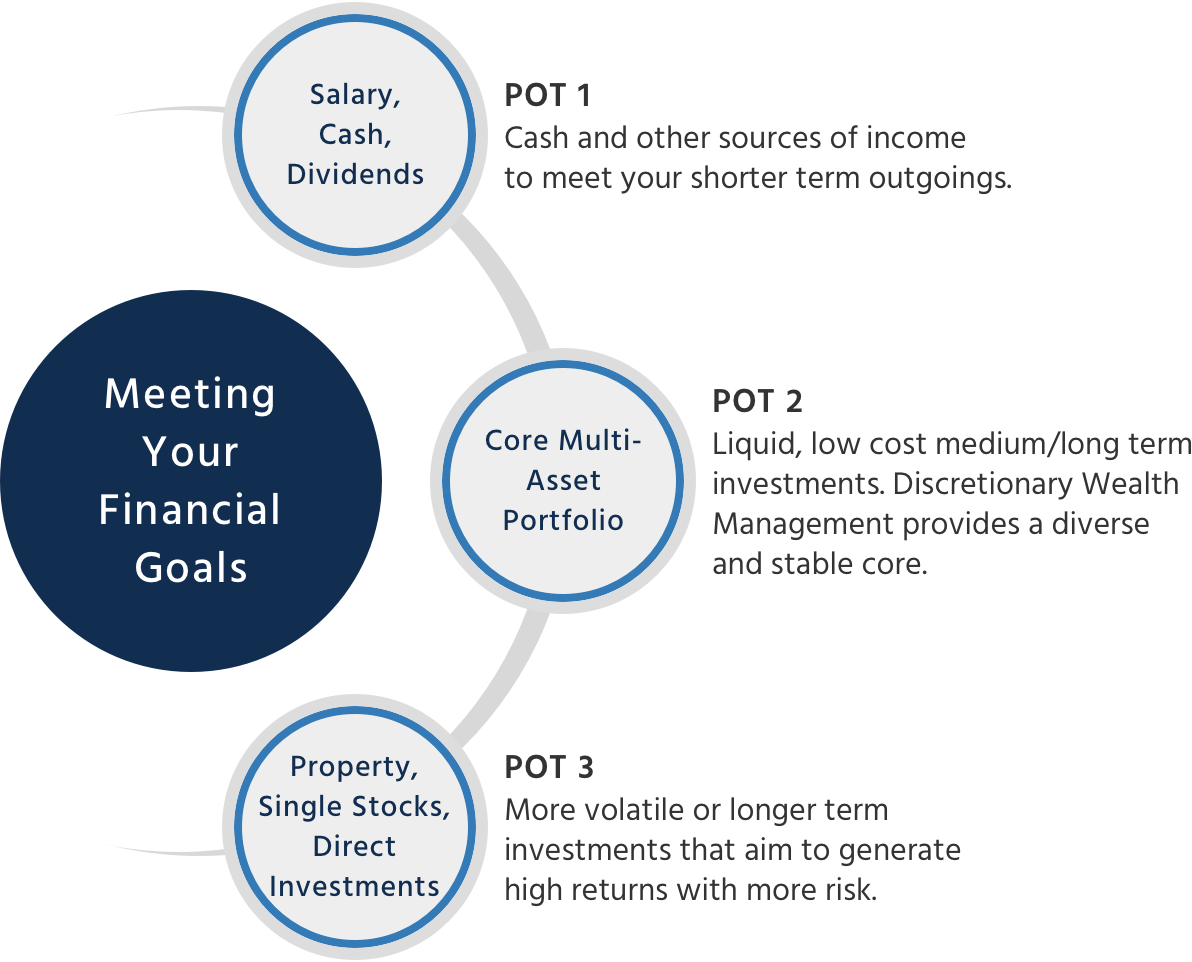

Meeting your financial goals with our "Three-pot Theory"™

A helpful way to think about your assets is managing them across three hypothetical pots. These pots tend to represent how we live our lives, thus making financial planning more intuitive and accessible.

Netwealth helps clients with Pot 2.

Pot 2 is designed to be the 'sleep well' money for investments that may need to help generate a secure income over the medium to long term, such as for school fees, retirement or for elderly care. It is usually funded by savings in ISAs, pensions and general investment accounts. Pot 2 should be managed in a way which ensures it is flexible, transparent and low cost.

Our Approach

Bespoke objectives

Defining your objectives and planning for the future will help you choose the right combination of risk levels and account types.

These choices will always be the biggest driver of your portfolio outcomes. We have a team and tools to help you put a plan in place and check back in on a regular basis.

Centrally managed portfolios

Our centrally managed approach to investment ensures you always access the best thinking of the firm.

Netwealth’s experienced team have carefully combined different asset classes to provide you with globally diversified portfolios, either from our range of core portfolios or socially responsible investment strategies, with the aim of maximising return for your chosen level of risk.

Improving the bottom line

We focus on the elements of investing that are within your control. By lowering the costs of investing and making use of tax wrappers and allowances where possible, you can significantly improve your net returns.

Netwealth's service can add to your investment results with our wide range of account types and helpful automation features.

When investing your capital is at risk

Executive Team & Board of Directors

Executive Team

Charlotte Ransom

Founder and Chief Executive Officer

Thomas Salter

FOUNDER AND CHIEF INFORMATION OFFICER

Gerard Lyons

Chief Economic Strategist

Iain Barnes

Chief Investment Officer

Matt Conradi

Deputy CEO and Head of Advisory & Client Proposition

Rachel Willox

CHIEF OPERATING OFFICER

Charlotte's Biography

Charlotte is a key player in the evolution of UK wealth management, a pioneering leader and a champion of diversity and financial wellness. She featured as one of PAM’s '50 Most Influential' each year from 2019 to 2022 and has been recognised annually in the Spear’s Power List since 2021.

Following a distinguished 20-year career at Goldman Sachs, serving as a partner for 10 years, Charlotte launched the first truly hybrid wealth management service with Netwealth in 2016. At the centre of her vision is the combination of the best bits of a traditional service with improved transparency, control and accessibility, all at a fraction of the typical cost.

Charlotte is a Vice President of Save the Children and a regular speaker with Speakers for Schools. She is an active donor and supporter of both medical science and educational projects.

Charlotte read modern languages at Bristol University and is a keen tennis player, often involving other competitive members of her large family.

Thomas's Biography

Tom is co-founder of Netwealth and oversees technology at Netwealth, as well as the overall operating platform in conjunction with the Chief Operating Officer. He is responsible for technology strategy and implementation, and for ensuring that Netwealth's technology platform underpins our products and services for clients in a first-class way.

Tom has more than 20 years' experience in financial services, the majority spent at JPMorgan where he was a Managing Director and head of the equity and multi-asset quantitative investment strategies team. Tom joined JPMorgan as a graduate in fixed income derivatives in 1998, before moving to Goldman Sachs to work with Charlotte. He rejoined JPMorgan in 2004, after spending a year’s sabbatical sailing around world.

Tom holds a master’s degree in Aeronautical Engineering from Imperial College and the CISI Private Client Investment Advice and Management qualification. Tom lives on the south coast where he and his family can enjoy time on the water.

Gerard's Biography

Gerard joined Netwealth in May 2016. He is responsible for Netwealth’s macroeconomic outlook and strategy, and is a member of the investment committee. He was previously Chief Economic Adviser to the Mayor of London, a role he took up in January 2013. Gerard spent 27 years as an economic strategist, serving as Global Chief Economist at Standard Chartered between 1999 and 2012.

Gerard’s first book, 'The Consolations of Economics', was a Daily Telegraph Book of the Year and was released as a paperback by Faber & Faber in June 2015. He is a frequent commentator in the press and on television and he holds a number of advisory roles, including TheCityUK and Warwick University Business School.

Gerard has an undergraduate degree from the University of Liverpool, an MSc in economics from the University of Warwick and a PhD in "Testing the efficiency of financial futures markets" from the University of London. Gerard also co-hosts a podcast ‘Elfonomics’ with his daughter Elf Lyons.

Iain's Biography

Iain joined Netwealth at the beginning of 2016 to launch the Netwealth investment portfolios in May of that year. He leads the Netwealth investment process and holds responsibility for the positioning and performance of all client portfolios, in addition to communicating the team’s views on markets.

A passionate believer in the importance of disciplined efficiency in delivering attractive returns to clients, Iain advocates for scalable and diversified investment strategies implemented in a cost-effective manner.

Prior to joining Netwealth, Iain spent 15 years in multi-asset investment management, holding senior portfolio manager roles at Schroders and UBS Asset Management. At UBS he was an Executive Director in the Global Investment Solutions division and one of six voting members of the Global Asset Allocation and Currency Investment Committee, responsible for more than £60 billion assets under management.

In his spare time, Iain enjoys watching his three sons play sport and he coaches a junior football team. He has been a CFA charter holder since 2003.

Matt's Biography

Over the past 15 years, Matt has worked with a wide range of clients and families to build their financial plans and manage their investments. As head of Client Advisory, he has helped to develop Netwealth’s proprietary wealth planning tools, financial advice and guidance services, so that clients can make more informed decisions about their financial futures.

Prior to Netwealth, Matt was a portfolio manager for private clients, at Julius Baer and Merrill Lynch in London, managing multi-asset portfolios and direct UK equity mandates.

Matt read Economics at Durham University, is a CFA charter holder and a member of the Chartered Institute for Securities and Investments (MCSI). He is a keen golfer, runner and, when possible, spends time in Brittany with his wife and new baby.

Rachel's Biography

Rachel is Chief Operating Officer at Netwealth. She headed up Operations and Client Service for the first 9 years helping take the firm from a start-up to the established wealth manager it is today.

She is responsible for the smooth operation of the business from client onboarding and transfers to cash management, trading and the daily functioning of the technology and controls.

Drawing on her extensive years of experience in Investment Banking Operations at JPMorgan, where she worked from graduate level up to Executive Director in both Equities and Fixed Income, she has built a streamlined and best-in-class control environment with a focus on providing the very best service to our clients. She is entrepreneurial, pragmatic, positive and focused and uniquely positioned to manage the continued evolution of Netwealth’s operation as it grows in scale.

Rachel read History and French at Bristol University and holds the CISI Investment Advice Diploma. She is still an enthusiastic Francophile, with a keen interest in people development, diversity, and championing working mothers. She can also be found in the Alps during the ski season with her teenage son.

Chris Arnold

Chief Technical Officer

Chris Charlton

CHIEF FINANCIAL OFFICER

Francisco van Zeller

CHIEF MARKETING OFFICER

Michael Harden

HEAD OF COMPLIANCE & MLRO

Chris's Biography

Chris has nearly 30 years' experience of building and delivering technical products across a wide variety of industries. His main focus is FinTech, but his journey started in the 80s when his parents bought him his first home computer.

At Netwealth, Chris is responsible for aligning tech strategy, product, data security, and IT infrastructure with the business strategy. To enable these to function at scale, Chris has recruited amazing teams across Product and Engineering, and is proud of the diversity Netwealth has managed to attract and retain.

Chris promotes technical excellence across all his teams and has created a culture of learning, productivity and growth.

When not working, Chris spends his time perfecting coffee, playing guitar, and surfing with his family near their home in Devon.

Chris 's Biography

Chris joined Netwealth in April 2016 and has responsibility for finance and risk, together with providing support to the compliance function. Previously Chris was the CFO of a UK based alternative investment manager and qualified as a chartered accountant with Arthur Andersen.

Chris read Economics at Durham University and is a keen sportsman, with golf and cricket his two particular passions. He also enjoys spending time with his wife and two young daughters who have family in New Zealand. Chris was able to demonstrate that remote working is feasible anywhere in the world recently when spending several weeks in New Zealand to introduce the latest family member.

Francisco 's Biography

Francisco leads Netwealth’s marketing and PR communications. He joined the firm in 2016 and, together with his team, has been responsible for bringing Netwealth’s brand and unique proposition to the forefront of the UK’s financial consumers’ consciousness.

Francisco has more than 20 years' experience in marketing and sales both at large organisations and start-ups. He co-founded the first online market research company in Iberia and successfully sold it to the French group Fullsix in 2008. He then joined Samsung, first at their headquarters in Asia and later in London to lead the company’s digital marketing agenda. Prior to joining Netwealth, Francisco was Chief Marketing Officer at Rentify, a London based start-up disrupting the property lettings space. He is also an active start-up mentor in both the UK and Portugal.

Francisco holds a degree in Economics from Lisbon’s Catholic University and an MBA from INSEAD. In his spare time he enjoys Bodyboarding, Tennis and Padel with his four boys.

Michael's Biography

With over 20 years’ experience in financial services compliance starting at Burns Anderson, Michael has worked with several traditional wealth managers, including Brewin Dolphin, Kleinwort Benson and Coutts, before running his own Compliance consultancy and later holding Deputy and Head of Compliance positions at Duncan Lawrie and Henderson Rowe.

Michael has been a crucial member of the Netwealth team since January 2019. With Netwealth’s ideology at heart, and the determination to offer our clients the best value, he has helped lay some of the key foundations for the company’s growth and development. Michael holds the International Compliance Association (ICA) Diploma in Compliance, along with professional qualifications with the Chartered Institute for Securities & Investment (CISI) and Chartered Insurance Institute (CII).

In his free time, Michael is a keen outdoorsman, who has dedicated time to expanding his knowledge of different cultures by travelling the world and visiting new places with his wife and children.

Board of Directors

Edward Bonham Carter

Michael Hartweg

Charlotte Ransom

Thomas Salter

Matt Conradi

Eva Sanchez

Edward 's Biography

Edward became Vice Chairman of Jupiter Fund Management plc in March 2014, having been Chief Executive Officer of the Company since June 2007. During his time as CEO, Edward steered the Company through an MBO in 2007 and its successful IPO in June 2010. Edward is Director of Stewardship and Corporate Responsibility at Jupiter, supporting the work of the CIO office and the Governance and Sustainability team. He chairs both the Stewardship and CSR Committees.

Edward is Senior Independent Director at both Land Securities Group plc and ITV plc; a Trustee of the Esmée Fairbairn Foundation; a Director of The Investor Forum; a member of the Strategic Advisory Board of Livingbridge LLP; and the Chairman at Netwealth.

Michael's Biography

As a Founding Partner of Leonteq Securities, Michael was responsible for the build-out and development of one of Europe’s most successful FinTech companies, which has been listed on the Swiss Stock Exchange since October 2012.

Prior to founding Leonteq, Michael held senior positions in trading and structuring at Goldman Sachs and Commerzbank. He holds a master’s degree in Business and Engineering Science from University Karlsruhe, Germany. Today, Michael invests in and advises companies in finance, technology and sports.

Charlotte 's Biography

Charlotte is a key player in the evolution of UK wealth management, a pioneering leader and a champion of diversity and financial wellness. She was recognised by PAM as one of the `50 Most Influential` in 2019, 2020, 2021 and 2022.

Following a distinguished 20-year career at Goldman Sachs, serving as a partner for 10 years, Charlotte launched the first truly hybrid wealth management service with Netwealth in 2016. At the centre of her vision is the combination of the best bits of a traditional service with improved transparency, control and accessibility, all at a fraction of the typical cost.

Charlotte is a Vice President of Save the Children and a regular speaker with Speakers for Schools. She is an active donor and supporter of both medical science and educational projects.

Charlotte read modern languages at Bristol University and is a keen tennis player, often involving other competitive members of her large family.

Thomas 's Biography

Tom is co-founder of Netwealth and oversees the operating business across portfolio management, operations and technology, as well as the build-out and evolution of new aspects of the service.

Tom has more than 20 years' experience in financial services, the majority spent at JPMorgan where he was a Managing Director and head of the equity and multi-asset quantitative investment strategies team. Tom joined JPMorgan as a graduate in fixed income derivatives in 1998, before moving to Goldman Sachs to work with Charlotte. He rejoined JPMorgan in 2004, after spending a year’s sabbatical sailing around world.

Tom holds a master’s degree in Aeronautical Engineering from Imperial College and the CISI Private Client Investment Advice and Management qualification. Tom lives on the south coast where he and his family can enjoy time on the water.

Matt's Biography

Over the past 15 years, Matt has worked with a wide range of clients and families to build their financial plans and manage their investments. As head of Client Advisory, he has helped to develop Netwealth’s proprietary wealth planning tools, financial advice and guidance services, so that clients can make more informed decisions about their financial futures.

Prior to Netwealth, Matt was a portfolio manager for private clients, at Julius Baer and Merrill Lynch in London, managing multi-asset portfolios and direct UK equity mandates.

Matt read Economics at Durham University, is a CFA charter holder and a member of the Chartered Institute for Securities and Investments (MCSI). He is a keen golfer, runner and, when possible, spends time in Brittany with his wife and new baby.

Eva's Biography

Eva is the Chief Legal Officer of GSR and oversees the firm’s legal, compliance and regulatory policy affairs. Prior to joining GSR, she was at AQR Capital Management and led the firm’s international legal and compliance teams and at Citadel where she oversaw the growth of Citadel’s hedge fund and securities business in Europe at a time of significant market structure and regulatory change. Eva started her legal career at Clifford Chance and obtained a First Class Business & Law Degree from City University, London.

Netwealth in the Press

"Netwealth’s straightforward technology and emphasis on lower fees has attracted clients looking for something new in the sector.

”

Contact Us

+44 (0) 20 3795 4747

Feel free to call us any time between 8-6 Monday to Friday

clientservice@netwealth.com

Email the team and we will respond as soon as possible

Netwealth Investments Ltd

Two Fitzroy Place, 8 Mortimer Street, London, W1T 3JJ

Have a complaint to make about Netwealth?

If at any time you wish to make a complaint in relation to our services to you, please contact the Head of Client Service at complaints@netwealth.com and we will endeavour to resolve your complaint promptly.

If your complaint remains unresolved 8 weeks from the date you made the complaint, you have the right to refer it to the Financial Ombudsman Service, whom can be contacted by:

- Mail: The Financial Ombudsman Service: Exchange Tower, Harbour Exchange Square, London E14 9SR

- Email: complaint.info@financial-ombudsman.org.uk

- Phone: 0800 023 4 567

In accordance with FCA rules we maintain professional indemnity insurance commensurate with the nature and scale of our business.